If you can afford to pay rent, chances are you might be able to afford to buy a home. Bad credit should not limit your financing options, and there are companies that offer flexible loan options even with bad credit. You may, however, need to streamline your expenses, pay your debts on time, and add a few more income streams to qualify for a mortgage.

The most important question is not whether you can buy a home with poor credit, but whether you’re committed to making those monthly payments no matter what. In any case, having a low credit score means you’re already indebted. Why not let one of those debts leave you with a home once you’re done paying it back?

You will be faced with high-interest rates and shorter repayment terms, and you’ll likely be required to pay a larger-than-normal down payment, but, hey, at least you’ll have something to show for it!

Below are six tips on how to buy a house with a low credit score:

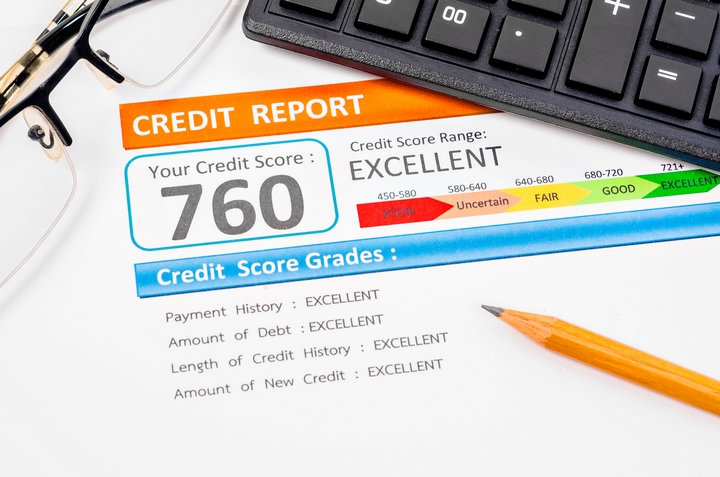

1. Know Your Credit Score

In order to buy a house with bad credit, you need to know exactly how bad your credit score is. You might think you have a low credit score, while in the real sense, it’s not that bad. To check your credit score, consult credit companies and some banks.

A low credit score is considered anything between 300 and 740, depending on the institution you’re seeking a loan from.

2. Scrutinize Your Credit Report to Highlight Errors

The credit report is a history of how you have dealt with debt payments in the past. If you have been paying your debts on time, without fail, it means you’ve been living within your means, and this will reflect in a good credit score.

However, some credit reports contain errors that result in a low credit score. If your low credit score is due to a mistake in reporting, raise the issue with the credit bureaus so the errors can be corrected and your credit score adjusted.

3. Be Prepared to Pay High Interest Rates

A low credit score doesn’t shut you out of the real estate market, and there are different ways on how to buy a house with bad credit. There are subprime lenders who are willing to take a chance on you. However, since they consider someone with a low credit score high risk, they charge higher rates than traditional lenders. They don’t do this to punish you but to protect themselves. By taking you on board, they know they will be risking late and missed payments.

High interest rates translate into an expensive mortgage. However, rather than pay rent for a house you’ll never own, you might still be better off with a costly mortgage for a home that will be yours, free and clear, someday.

4. Be Ready to Deposit a Substantial Down Payment

If you are prepared with a large down payment, subprime lenders would be willing to have you on board. In the regular mortgage market, you can get loans with just a 3% down payment or less. However, if your credit score is bad, your mortgage application stands a better chance if you’re willing to bump up your down payment. This logic resonates with that of charging high interests to borrowers with low credit scores.

Committing to a larger-than-normal down payment indicates to a lender your willingness to absorb some of the risks. Since you have invested more of your funds in the home loan, the lender believes you are unlikely to default on the mortgage. Things will get better if you can raise a down payment of 20% or more, in spite of your less-than-impressive credit score.

5. Apply for Homeowner Incentives

You may need to pay a higher down payment if you have a low credit score, but you might still be able to reduce your cost by applying for government homeowner incentives. The First-time Home Buyer Incentive can help you finance part of the home purchase. The Home Buyers’ Amount assists first-time buyers by offering up to $5,000 in an income tax credit to help cover the legal fees, land transfer taxes, and disbursements you’ll have to pay when you buy your first home.

The Home Buyers’ Plan allows you to withdraw up to $35,000 from your RRSPs per year to buy a home. And the GST/HST New Housing Rebate allows you to recover part of the GST or HST paid on the home.

6. Systematically Start to Rebuild Your Credit

In some cases, a credit score can be so bad that no lender wants to touch it. Even subprime lenders have a limit as to how much risk they are willing to take. If your credit is this bad, the only option at your disposal is to start building it. You may not get rid of those adverse reports overnight, but you can start by making sure you pay all your bills whenever they fall due.

And since a lower credit card debt reflects favourably on your credit score, settle as much of your credit card debts as possible. While it takes discipline and patience, repairing your credit history is doable.